China’s Water Industry is Still Attractive with Strong Fundamentals

Eric Cheng

Industry Specialist, Infrastructure Sector

Asia Pacific

Core to a country’s economy, the water industry provides drinking water, wastewater services, and other related infrastructure services to the residential, commercial and industrial sectors. The industry in China has gone through a drastic evolution, with different players taking control over the years. Before 1992, under the planned economy, all water related companies were owned and operated by State Owned Enterprises (“SOEs”). Economic reforms, accelerated from the early 90’s, have led to unprecedent growth in industrial output and thus, China’s economy. To meet the capital required to support growth, the water industry was opened to investments from foreign and domestic private investors. Since then, most major international water operators have entered the market. Benefitting from favourable policies and experience gained from working with international operators, domestic private investors have become a force to be reckoned with in developing the industry since 2002. After 2015, public–private partnership (PPP) and build-operate-transfer (BOT) have been the most popular forms of investment, as projects have become more complex, and the technical and financial requirements more specific. At the same time, major industry players have readied themselves for new challenges. Most of the top 20 water companies are either listed or are owned by international water operators, such as Beijing Enterprise, Guangdong Investment, Beijing Capital, Veolia, Suez NWS, China Water Affairs, and China Everbright Water.

The industry is regulated, with different companies enjoying monopoly-like situation in the regions they operate. Water tariffs are subject to government control and determined through public hearing processes. Typically, tariffs may be increased every 2 to 3 years under a BOT contract, taking into account rising production costs, inflation, and encouragement to conserve water. Between 2006 and 2018, China’s average water tariff (including wastewater treatment charges) increased at a similar pace to the country’s CPI.

Unique growth and value drivers

In most developed countries, we see little increase in population and limited growth in industrial production. Demand for water supply as such, is either stagnant or on the decline. Indexing to the CPI and increasing tariffs are the most important drivers of value in the industry. However, China is still in the early stages of industrialisation and thus, demand for water and related services will only continue to increase significantly. Water tariffs in China are also meaningfully lower than in developed countries. Yet given the acute shortage of domestic water resources, it would also make sense for China to increase tariffs at much faster pace.

"In most developed countries, we see little increase in population and limited growth in industrial production. Demand for water supply as such, is either stagnant or on the decline."

Industrialisation and urbanization trends

industrialisation, urbanisation, and incentivising water conservation through management of water tariffs are the key drivers of growth in China’s water industry. Industrial Production averaged circa. 11% p.a. growth from 1990 to 2020, and is expected to continue to grow over the medium term

To support growth, the country has been going through a process of urbanisation, which saw hundreds of millions of citizens move to cities, marking the greatest migration from rural to urban areas in global history. Factories, business parks, and special economic zones were built across the country. With the advantages of a large population, low labour costs, sound infrastructure, and supportive government policies, China became the “Manufacturer of the World”. This industrialisation process has been supported by infrastructure development, including that of the water industry, and urbanisation will continue to be the catalyst for the growth of the water industry going forward.

Upside in water tariffs

Water resources are unevenly distributed between the North and South of the country. Over 81% of China’s water resources are concentrated in the industry-heavy South and less than 20% in the agrarian north, which covers 64% of the nation’s territory and 46% of its population. This uneven water resource distribution has driven higher average tariffs in the North and West, and therefore arbitrage opportunities for investors. Tariffs can also be used as a tool to encourage water conservation and innovation.

Overall a growing and profitable industry

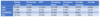

The performance of the major water and related listed companies in China provides a vote of confidence on the viability and profitability of the industry. In the table below, 6 of the listed companies from different regions were selected for benchmarking. The average return on net assets and capital in high single digit reflects the market return for regulated utilities. The high EV/EBITDA and P/E ratios are indications of investors’ expectation for the growth of the industry.

Major Water and Related Listed Companies in China - Return and Valuation Indicators of FY 2019

Source: Bloomberg, FY2019 (pre-Covid)

The outlook for the Chinese water sector is promising, with considerable positive momentum. There is still room to increase tariffs; demand is increasing as urbanization rates grow and infrastructure investments remain in need of a boost; there are also growing environmental pressures on wastewater treatment and water conservation. Further, during the coronavirus pandemic, and due to the nature of the industry, the water sector has remained relatively resilient.

"The outlook for the Chinese water sector is promising, with considerable positive momentum."

Structural changes driving investment opportunities

Apart from the attractive growth potential and solid fundamentals of the sector, China’s water market is also experiencing structural changes which provide new investment opportunities. First, as the Chinese government seeks to further open its economy to foreign investors in order to support its growth – even more so in light of the coronavirus pandemic and tensions with the US – the National Development and Reform Commission (NDRC) announced in June that it was scaling back its "negative-list", lifting a rule stipulating that the construction and operation of urban water supply and drainage pipeline networks for areas with a population of 500,000 or more must be controlled by Chinese companies. Second, established MNCs in China are adjusting their strategy and approach to the Chinese market, choosing to invest more, exit the market and divest, or restructuring their investments and businesses. A number of MNCs are considering adapting to an asset light strategy in the water business, selling part of its shareholding in the assets to financial investors and focusing on being operators and service providers. These developments should support increasing deal making in the water sector in China.

Infrastructure is one of the key strategic sectors for Natixis across product lines, and together with our M&A boutique Partners, we are actively supporting our global and local infrastructure clients and investors on their strategic and financial moves.