China Cross-Border M&A in the New Era

Edward Radcliffe

Partner

Vermilion Partners

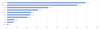

Followers of global M&A will have noticed that most developed economies witnessed a record surge in activity in 2021, while, by contrast, China cross-border M&A slumped – both in terms of number and value of deals.

This article seeks to highlight areas in which China cross-border M&A remains active, identify future opportunities and set these within the context of the current environment.

Source: Mergermarket

Since early 2020, Covid-19 and challenging geopolitical undercurrents have conspired to restrict investment activity into and out of China. The slump has not been universal across the board: in natural resources, technology and healthcare Chinese buyers have been active oversees. Foreign multinationals, on the other hand, continue to look for opportunities in the healthcare, new energy vehicles (NEV) and new energy markets in China. In addition, a number of multinationals have reassessed their China businesses and, in some cases, sought to restructure them – whether by investing further, selling down or a combination of the two. This latter development has been brought about as much by the latest economic trends in China, the concentration of resources on other markets, as a concern for resilience across international supply chains.

The World We Live In – And What It Means for China M&A

The Covid-19 pandemic

- Although many countries appear to be on the road to learning to live with the virus, in practical terms, travel into, out of and occasionally within China remains heavily disrupted.

- Technology has helped, but if the principals of potential parties to a transaction are not already familiar with each other it remains challenging to build trust in a business culture centred on interpersonal relationships.

- This has meant that advisors have sometimes needed to shoulder a heavier burden than usual in some transactions – often having to find creative solutions to progress deals.

The pandemic aside, China is grappling with a number of long-term trends. At the same time, it is taking on ambitious reforms designed to tackle them - sometimes with dramatic side effects.

"Pandemic aside, China is grappling with a number of long-term trends and at the same time, taking on ambitious reforms designed to tackle them - sometimes with dramatic side effects"

Demographics

- The demographic equation will continue to loom large in the formulation of government policy and corporate decision making. The rate at which the population is aging has been exacerbated by a rapid fall in the fertility rate. What this means is an increased focus on trying to raise productivity: a shift away from labour intensive industries and towards the greater use of industrial automation in manufacturing.

- The impact on healthcare has been sustained interest in aged care and a new focus on innovative drugs designed to reduce the burden on the broader population. In innovative drugs we have seen recent policies supporting increased funding of pharmaceuticals for rare diseases. At the same time there is continued interest in oncology pharmaceuticals and diagnostics, where we are seeing a fast growing and rich pool of local players.

Debt

- The campaign to rein in debt and move away from traditional infrastructure investment to spur growth is likely to further dampen GDP growth – arguably to a more sustainable rate. Last year’s clampdown on the real estate sector was highlighted by Evergrande’s travails. Although tempered since early this year, the government’s approach to the real estate sector is likely to result in lower growth given the sector’s outsized historical contribution to GDP – approximately 30%.

- We can expect further interventions from the government – more likely at the local level – to manage any restructuring in the sector.

- Construction equipment manufacturers may look to overseas expansion as an answer to cooling markets at home.

A Question of Balance

- Long term, sustainable growth in China depends on a more balanced economy, but the transition to a more consumption driven, as opposed to investment led, economy has been slow. (It has been further impacted by attempts to reform the real estate sector in 2021.) We have yet to see any major stimulation of the demand side of the economy; on the contrary, the government looks set to continues supply side investment in sectors such as infrastructure.

- China’s much vaunted dual circulation policy has resulted in greater emphasis by the state on ensuring strategic sectors of the economy are not deprived of key resources or technology. This should favour inbound investment in a few sectors, in particular certain hi-tech and healthcare niches. The challenge in hi-tech, in particular, lies in identifying opportunities that avoid falling foul of geopolitical tensions between the US and China.

- We expect restructurings to continue as multinationals train their focus on their core markets in the wake of the pandemic and as certain local markets experience greater competition, not least from well-resourced state-owned players with privileged access to capital. For example, in 2021, Vermilion advised Tereos on selling down its stakes in two China joint ventures to focus on its core markets and reduce debt.

"Long term, sustainable growth in China depends on a more balanced economy, but the transition to a more consumption driven, as opposed to investment led, economy has been slow."

The Long March Towards a Net Zero Future

- China’s energy transition is a clear bright spot. Although still heavily dependent on coal for power generation, the country has started to make a marked shift to support nuclear and renewable sources of power, while at the same time put its new energy vehicle (NEV) initiatives at the front of the international pack.

- Chinese auto manufacturers already account for 40% of world electric vehicle (EV) sales and the country leads the world in EV battery components too – its market share for battery components increasing from 43% in 2014 to 60% in 2020. (It is worth remembering that batteries represent more than 40% of the total cost of an EV.)

- While clearly leading in EVs, the government is now turning its attention to hydrogen fuel cell vehicles (FCVs) and in certain components, such as membranes, China boasts competitive players.

- We have witnessed a clear rise in activity among Chinese companies looking overseas for strategic M&A opportunities that support either geographic expansion or the acquisition of key resources and technologies. And the Chinese market has appeal to Europe’s leading players in the hydrogen economy.

- The new energy market, including renewables and NEVs, has been active for Vermilion:

- At the end of 2020 we helped one of the world’s largest auto manufacturers restructure its China platform to better position it for growth in EV and other markets. We advised PSA (now part of Stellantis) to sell its Shenzhen based joint venture intended to produce internal combustion engine vehicles with Chang’an Auto.

- In 2021, we advised China Three Gorges Group (CTG) on the acquisition of seven wind and solar projects in Egypt and Jordan with a total generation capacity of 411MW.

- And looking further upstream, Azure and Vermilion have been advising Prospect Resources on the sale of its Arcadia lithium project in Zimbabwe to Huayou Cobalt that was announced on 23 December 2021.

"In China we see well-funded private companies alongside state-owned groups pursuing strategic agendas continuing to look for opportunities overseas, whether it be access to new markets, technology or resources."

In 2021 we saw M&A pipelines replenished after the tumult of 2020. As expectations increase of a normalisation in international travel our clients will be remaining mindful of geopolitical tensions and economic headwinds as they navigate growth opportunities outside their home borders. In China we see well-funded private companies alongside state-owned groups pursuing strategic agendas continuing to look for opportunities overseas, whether it be access to new markets, technology or resources.

Foreign investors in China, on the other hand, can expect consumption to grow over the long term, with a positive outlook for high quality consumer products, healthcare and new energy while at the same time the manufacturing base continues to modernise.