Asia Renewables: A bright spot on the M&A horizon

Jonathan Tse

Co-Head of Energy Transition and Natural Resources, Asia Pacific

Natixis CIB

As the world collectively grapples with the challenges posed by climate change, renewable energy will be an important driver of the energy transition.

Over the past decade, the sector has experienced remarkable growth in Asia Pacific, led by countries such as China, India and Australia. Today, Southeast Asia (SEA), Japan, and Korea are fast catching up as they accelerate their renewable energy initiatives. This growth has attracted massive investment and a flurry of deal activity, with the sector becoming a bright spot in the APAC M&A market, particularly in Southeast Asia.

How has the renewables M&A market in the region evolved over the past few years and what is the outlook? With Natixis CIB having recently secured the #1 position in Dealogic’s SEA renewables M&A ranking, we thought it would be a great opportunity to delve further into this topic.

"Clear regulation, consistent policies, and bankable tariff structures are essential to building investor confidence and encouraging capital inflows towards renewable projects and building up local value chains."

A diversification of ownership

There are several important factors driving the trend of growing renewable sector M&A in APAC.

Firstly, strategic and financial investors are generally well-capitalized and have significant dry powder and appetite to pursue acquisition targets. With a broad preference for energy transition and defensive sectors, renewables is typically high on their list of priority targets.

Secondly, the monumental ambitions for renewable capacity growth across APAC markets require substantial debt and equity capital. As existing developers of projects look to recycle capital and seek partners to fund future developments, this will lead to a diversification of ownership in the region.

Additionally, growing policy support across different markets has been an instrumental factor in driving renewables penetration in APAC. Clear regulation, consistent policies, and bankable tariff structures are essential to building investor confidence and encouraging capital inflows towards renewable projects and building up local value chains.

Strong deal environment

As governments and the private sector intensify their efforts to meet ambitious clean energy targets, companies are in a race to develop wind, solar, hydro, BESS (Battery Energy Storage Systems), and other sustainable energy projects across APAC. In the past two years, capital continued to flow into regions with favorable structural growth drivers, clear energy regulatory regimes, and clear government and political support for the sector.

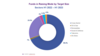

This robust environment led to over US$30 billion worth of renewables M&A transactions in APAC in 2022 alone, according to Dealogic. Notably, Australia, SEA, and India accounted for approximately 90% of these deals.

Natixis CIB advised on several key transactions in SEA in 2022, including:

- RATCH’s US$605 million acquisition of Singapore-based Nexif Energy

- WIRCON’s sale of Australian renewables platform WIRSOL Energy to Gentari

- Gentari’s acquisition of a 29.4% stake in the Hai Long offshore wind project from Northland Power

While the market has slightly cooled in the first half of 2023 compared to 2022, the pipeline of deals in execution remains strong.

"Longer-term, we believe significant equity capital will also be raised for offshore wind projects, with countries like Taiwan, Japan, Korea, the Philippines, and Australia promoting supportive policies and garnering increasing investor interest. "

Outlook – smaller deals, larger volumes

Looking ahead, while there remains a few large regional platforms that may come to the market in near future, we believe the majority of deals going forward will be driven instead by smaller developers and country-specific portfolios, as they seek financial backing or aim to sell operating assets to recycle them into future developments. Geographically, Australia and India are expected to maintain robust deal flow over the next year, with opportunities also emerging in Japan, Korea, and Vietnam.

In terms of technology, utility-scale wind and solar projects still dominate, but deals in BESS and C&I (Commercial and Industrial) solar spaces are on the rise. As the sector matures and market liberalization spreads across various countries, BESS and C&I solar will continue to gain a greater share of total deal flow.

Longer-term, we believe significant equity capital will also be raised for offshore wind projects, with countries like Taiwan, Japan, Korea, the Philippines, and Australia promoting supportive policies and garnering increasing investor interest.

It’s also notable that among sector-specific funds raised globally over the past year, renewables is a clear favorite, according to data from IJInvestor.

In closing, the APAC renewables sector is set for continued robust growth, driven by strong investor interest, ambitious corporate energy transition targets, and favorable policy. It is expected to be a bright spot in regional M&A market activity and reflects huge potential for bringing transformative change to the region.

As seen with our recent successes, Natixis CIB is well positioned to provide both the M&A advice and our balance sheet to support this energy transition drive.