The Resilience of the Boutique Approach

Miranda Zhao

Head of Mergers & Acquisitions

Asia Pacific

While the world continues to grapple with the impact of the pandemic and M&A activities suffer severe disruptions, businesses have started to adapt their strategic activities to this new environment and some structural changes have emerged. We have witnessed more “de-globalization” transactions, with multinationals exiting foreign markets, sector rotation with increased deal activity in TMT (Technology, Media, Telecoms), distressed situations and restructuring deals in hard-hit industries such as energy, mining and consumer sectors, for example.

The dramatic changes in M&A markets have impacted all advisors, from bulge bracket banks to boutique firms. While some bulge bracket banks have been able to offset the significant drop in M&A advisory fees with revenues from their equity and debt capital markets businesses, and sales and trading desk activities, some boutique firms are also trying hard to capture more M&A revenue opportunities by diversifying their services, notably focusing more on restructuring or other strategic advice, including advising companies on financing and special situations.

"The dramatic changes in M&A markets have impacted all advisors, from bulge bracket banks to boutique firms."

In this challenging market, some banks have reduced their presence in investment banking, allowing the remaining players to consolidate their respective market shares. Boutique investment banks have been the fastest to adapt to the new M&A environment. In fact, some focused boutiques have emerged as “winners” in this market environment – namely those that have strategically focused on resilient sectors, restructuring practices and fundraising firms, especially the tech sector, which has outperformed significantly.

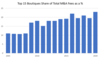

Overall, boutiques have seen their M&A share of wallet increase in the past few years, but notably in 2020 in the current environment. Potential key drivers of this rising market share may include their differentiated on-the-ground teams with a significant hands-on approach from senior bankers, their niche expertise in specific products or sectors to deal with more complicated or non-typical M&A situations, and the fact that they are more agile and able to quickly adapt to the new market trends in both their approach with clients and strategically.

Source: Refinitiv

In Q3 2020, we saw some signs of recovery in the M&A market across APAC, although uncertainties remain. While the total number of deals has continued to drop by 16% on a Y-o-Y basis, the third quarter recorded a dramatic 76% increase in deal value, mainly driven by a significant increase in large domestic transactions in China and South East Asia. The top 8 transactions accounted for 53% of total deal value this quarter.

China’s market-oriented government policy to reshape some of the key sectors and industry consolidation in the APAC region are the driving factors for this market trend. Domestic, inbound, restructuring and special situation transactions account for an increasing market share in overall M&A markets this quarter. Accordingly, boutique M&A houses are playing a much more important role in participating in these transactions, leveraging their on-the-ground teams and expertise on complex M&A situations.

That said, there are limitations to the pure boutique model. Most boutiques are not able to offer a comprehensive suite of products to their clients. For instance, they typically are not able to provide financing directly, whether that be debt, equity or other structured financing. Some also lack a global network, and are not able to support clients on cross-border transactions. Their bankers may have built strong relationships with their clients, but their scale and limited product range often restrict the business they can capture.

Maintaining the strengths and the unique “DNA” of the boutique model while providing the benefits of a larger and global platform is somewhat of an artform. At Natixis, we have built a truly unique network of leading boutiques, across geographies and industries, providing clients with a differentiated offering. They benefit from the local and sector expertise of senior advisors, as well as the strong support of Natixis, when needed, providing tailor-made financing solutions and global connectivity with best-in-class resources.

"Maintaining the strengths and the unique “DNA” of the boutique model while providing the benefits of a larger and global platform is somewhat of an artform."

We have seen concrete progress in transactions we have been working on with our boutiques in Asia, Vermilion Partner and Azure Capital. While we are not yet in a position to discuss all activities, we can point to the success of our Australian boutique, Azure Capital, who announced 4 transactions in as many months, including buyside and sellside roles for assets in the infrastructure and metals & mining sectors, a complicated special situation transaction resulting from the impact of Covid-19, and the establishment of a renewable energy investment platform between a France-based global energy giant and Japanese trading house and the subsequent sale of their controlling stake to a leading Australian infra manager.

Our innovative approach to M&A, through our multi-boutique model, allows us to provide best in class service to our clients. The combined expertise of Natixis and its M&A boutiques, our ability to seamlessly execute transactions together as a team, delivering successful outcomes for our clients, are undeniable. The blend of boutique and large financial institution has allowed our business to remain resilient during this unexpected period, and we believe the combined agility and entrepreneurial mindset will continue to allow us to deliver best-in-class independent advisory for our clients and allow us to collectively thrive in this changing world.