Is the SPAC Wave Coming to Asia's Exchanges?

Asian exchanges have been reluctant to embrace the all-popular IPO structures but that might be set to change – now that Singapore has introduced its framework, will others follow?

Raghu Narain

Head of IB

Asia Pacific

SPACs have been the topic du jour for the past 21 months or so. Is it prime time for Asian exchanges to allow these IPO structures to list in the region, and should the Asian community contemplate sponsoring SPACs? One thing is for certain, investors and regulators need to take heed of the barrage of litigations taking place in the US post SPAC listing.

In recent months we’ve seen a variety of well-known Asian names embrace the SPAC trend, with the likes of L Catterton Asia Acquisition Corp in March and HH&L Acquisition Co in February, to name a few, announcing transactions in the US.

Other high-profile names are in on the action too, such as Richard Li and Peter Thiel – who have raised over USD1bn from three SPACs and are raising funds for a fourth – as well as New World Development’s Adrian Cheng, whose SPAC raised US$300m in May.

At the time of writing, the Singapore Exchange has announced less than 24 hours ago that it will allow SPACs to list. Previously, the only viable option for these SPACs would have been to list in the US, as in Asia only the Malaysian and Korean Stock Exchanges allowed SPAC entities to list.

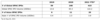

SPACs are not a new trend. In their rawest form, they’ve been around since the 1980’s. If we fast-forward to more recent data, we can see that 2005 was the beginning of the recent SPAC trend – when about 30 SPAC IPOs took place, followed by a complete drop-off in 2008/2009.

There was a resumption in activity in 2016 but 2019 was the real start of the ‘SPAC boom’ and of the most recent period of growth in activity.

Since 2019, the average SPAC IPO size has increased to about US$320m, with the average de-SPAC coming in slightly below at US$900m. With currently over 420 SPACs in the market, that represents in excess of US$100bn in capital to be deployed to acquire targets, with 24 months or less to complete.

“As suitable targets (in the US) become more and more difficult to find, SPACs will either have to settle for lower-quality targets, or pay a higher premium for better quality assets, at which point the return will no longer make sense for shareholders.” – Miranda Zhao, Head of M&A, Asia Pacific

VIABLE TARGETS

As the only feasible option for many of these blank-cheque companies for a long time, the US market has become extremely crowded. Which has created a difficult for those searching for a viable target.

For Asia – South-east Asia and China in particular – though, where a number of great target companies are ready to potentially “de-SPAC”, enter business combinations and public listings, this bodes well.

But just as Asian exchanges have begun to publicly demonstrate interest in the phenomenon, SPAC market dynamics in the US look to be slowing down. What is obvious is that there is clear downward pressure on the market. But whether that is in the form of slight cooling or a broader correction, remains to be seen.

The IPOX SPAC index, which tracks the after-market performance of SPACs (US IPO), and the Indxx SPAC and NextGen IPO Index, a passive index that tracks the performance of newly listed SPACs since 2017, have both dropped by around 30% since their respective peaks in mid-February.

MARKET BREATHER

Our view is that, rather than signalling an end of the recent boom in activity, the market is taking is breather, having got ahead of itself. The fundamental conditions underpinning the heightened SPAC activity are still present – liquidity, higher volatility, dry powder with institutional investors, rapid innovation in technology and ESG context.

Of the two markets in Asia that have previously allowed SPAC IPOs, the track record has been somewhat of a mixed bag.

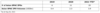

Since 2009, Korea has seen 199 SPAC IPOs list, 196 of which were on the Kosdaq. The remaining three that listed on the Kospi ultimately failed to find acquisition targets, and as such were disbanded. But NH SPAC 19 tested the mainboard waters once again, listing in May of this year, and to date, has traded just above its listing price.

Malaysia, meanwhile, has seen five SPACs list – two of which successfully navigated to find acquisition targets and become fully operational companies. The remaining three underwent liquidation – due to lack of a target, lack of shareholder approval, and lack of regulatory approval, respectively.

Other exchanges in the region are understandably cautious but change is on the horizon.

SINGAPORE PAPER

On September 2, the Singapore Exchange (SGX) released the results of its much-anticipated consultation paper, announcing that effective September 3, it would allow SPAC IPOs to list in the city state – becoming the first major bourse in Asia to do so.

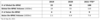

In order to ensure the structures are beneficial to companies, investors and the Singapore Capital Market the SGX has set requirements including a minimum market capitalization of SGD150m (down from the SGD300m mulled in the consultation paper), at least 25% of their total number of issued shares held by public shareholders that the de-SPAC must take place within 24 months of IPO with an extension of up to 12 months subject to fulfilment of prescribed conditions, and that all shareholders have redemption rights.

And at the same time, target companies have to meet SGX listing rules upon completion of the business combination, complying with shareholder, profit, revenue and market capitalization requirements.

Now that SPACs backed by regional sponsors or with a regional target acquisition mandate, will be able to access an investor base closer to their home markets, much work lies ahead in educating retail investors of the SPAC structure and de-SPAC process.

Especially as a significant pipeline of Singapore and regional companies are waiting in the wings to take advantage of the SPAC structure.

"Change is on the horizon... how Asian Exchanges will address SPAC listings remains at the forefront of most market participants' minds, but one thing is certain, there is no easy solution."

HONG KONG EXPLORATION

The Hong Kong Government has also indicated the city’s stock exchange would explore the possibility of allowing SPAC IPOs, and is believed to be targeting an initial SPAC listing taking place within 2021. But as the city’s regulators have tightened regulations on shell corporations and backdoor listings in the past few years, in a bid to curb market manipulation and speculative trading - there are concerns that allowing SPAC listings might oppose these efforts.

Likewise, Indonesia and Japan are also considering their options. The Australian exchange is taking a more visibly cautious approach at this stage, having held a series of informal discussions with market participants over recent months.

While Singapore has made the first move, question remains for many of these Asian exchanges – how to safeguard investors’ rights during-and-post business combination.

The very nature of the SPAC means that investors have little insight into the business that the listed entity will pursue, must rely on the target companies’ managements’ ability to deliver often lofty projections and thus must invest entirely based on the track record of the SPAC’s sponsors’ previous investments.

PROTECTION MECHANISMS

In the US, protection mechanisms – including lawsuits and various types of litigation – act as a safety net for investors. Indeed, of the 400 or so SPACs which have so far listed in the US 2021, multiple have come under the attack of class action lawsuits in recent months, for seemingly not delivering on the promises made during the investment phase. If these lawsuits prove anything, it is that it is important that markets maintain some form of discipline, and ensure that the ‘bad companies’ are removed from play.

In Singapore, the SGX requires the listed entities to comply with its longstanding listing requirements, and has implemented redemption rights for independent shareholders, among others, as an important mechanism for investor protection. How other exchanges will choose to ensure a high degree of security for investors, whether that be much greater scrutiny and/or regulation, or other means, remains to be seen. But one thing is certain, there is no easy solution.

To date, not many SPACs of Asian origins have found targets to proceed with their de-SPAC yet. Asian sponsors are, for now, still going to the US. But that will change soon. If, like Singapore, the rest of Asia wants to make the most of this trend, now is the time to take action.